Recently, the Political Bureau of the Communist Party of China (CPC) Central Committee held a meeting to analyze and study the current economic situation and plan economic work in the second half of the year. The meeting pointed out that it is necessary to effectively prevent and resolve risks in key areas, adapt to the new situation in which the relationship between supply and demand in China’s real estate market has undergone major changes, adjust and optimize real estate policies in a timely manner, and make good use of the policy toolbox because of the city’s policy to better meet the rigid and improved housing needs of residents and promote the stable and healthy development of the real estate market.

According to incomplete statistics, in the first half of this year, due to the city’s policy, real estate control policies were successively introduced for about 380 times. What are the characteristics of optimizing control policies in various places? What is the trend of the real estate market in the second half of the year?

Multi-point efforts in property market regulation

Since the beginning of this year, effectively preventing and resolving risks has become the main content of real estate policy regulation. On the one hand, multi-departments further increase financial support for real estate enterprises; On the other hand, the demand side focuses on reducing the cost of buying houses, and various localities have made precise policies in many aspects, such as mortgage interest rate adjustment, provident fund support policies, simplification of second-hand housing services, optimization of purchase restrictions, and housing subsidies.

According to the data of the Central Finger Research Institute, more than 40 cities across the country have adjusted the lower limit of the first home loan interest rate to below 4%. With the People’s Bank of China lowering the LPR interest rate for more than five years to 4.2% on June 20th, some cities still expect to lower the mortgage interest rate. Since the beginning of this year, more than 10 cities, such as Luoyang and Qingdao, have relaxed their credit policies by optimizing the criteria for identifying second homes and reducing the down payment ratio, with a view to promoting the healthy development of the real estate market. At the beginning of June, Qingdao reduced the down payment ratio of non-restricted areas, and residents’ home ownership sentiment picked up and market activity increased. Restrictive policies in non-core areas of hot cities may be further liberalized.

Judging from the housing provident fund policy, compared with the limitations of previous provident fund withdrawal, more than 100 places have introduced policies such as increasing the amount of provident fund loans, reducing the down payment ratio of provident fund, allowing provident fund to pay down payment, supporting "business-to-public" loans, and increasing the amount of rental housing to withdraw provident fund, so as to further support the release of rigid and improved housing demand by revitalizing the provident fund.

"From the perspective of policy effect, the further relaxation of credit policy is conducive to reducing the cost of home purchase and has played a positive role in promoting the release of demand for home purchase." Huang Yu, executive vice president of the Central Finger Research Institute, believes that for the real estate market, it is still necessary to superimpose more support policies at both ends of supply and demand in order to better play the policy effect.

Since the launch of the "third arrow" to support the financing of real estate enterprises, many listed real estate enterprises such as China Merchants Shekou, Poly Development, Fuxing, Lujiazui, China Communications Real Estate and Daming City have been approved by the Exchange, and the total amount of funds raised is about 35 billion yuan, most of which are used to supplement working capital and guarantee the delivery of buildings.

Zhang Bo, president of 58 Anjuke Research Institute, said that the current real estate development enterprises are gradually getting out of the financing dilemma. The approval of refinancing of housing enterprises will help enterprises to acquire land, start construction and build stably, and at the same time, it will also play a positive role in the orderly delivery of projects.

Overall, it showed a stabilizing trend.

In the first half of the year, all localities improved the policy accuracy due to the city’s policy, which better met the rigid and improved housing needs of residents and promoted the stable and healthy development of the real estate market.

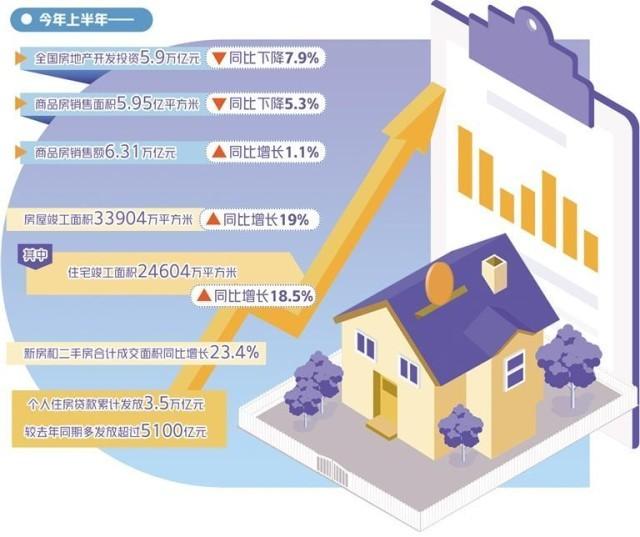

According to the data of the National Bureau of Statistics, in the first half of this year, the sales area of commercial housing nationwide was 595 million square meters, down 5.3% year-on-year, of which the sales area of residential buildings decreased by 2.8%. The sales of commercial housing was 6.31 trillion yuan, up by 1.1%, of which residential sales increased by 3.7%.

Specifically, in the first quarter, under the influence of factors such as the release of the previous backlog demand and the effective policies, the activity of the real estate market rebounded, and the real estate market in hot cities appeared "Xiaoyangchun" market. In the second quarter, the previous backlog of housing demand was released, and the market cooled significantly.

From the perspective of demand structure, the demand for improved housing in the first half of the year was still an important support for the market, and the proportion of transactions in the middle and high total price segments in many cities increased. In Beijing, Shanghai, Chengdu, Suzhou and other cities, the number of high-end residential products has increased rapidly, and the market has maintained a certain activity. In contrast, the activity of the second-hand housing market was better than that of the new housing market in the first half of the year, and the market expectation weakened synchronously in the second quarter.

However, there is uneven heat and cold in the land auction market. Land auctions in core cities have maintained a certain degree of heat, while land auctions in some cities have been indifferent. The data shows that in the first half of this year, Shanghai, Hangzhou and Hefei all accounted for more than 50% of the land price ceiling transactions, and some plots in Beijing and Hangzhou set a record for the number of land participating enterprises in recent years; Enterprises in the core areas of Guangzhou, Qingdao, Jinan, Tianjin and Fuzhou have a high degree of participation, while the non-core areas are mostly sold at the reserve price, and the differentiation between the plates is obvious; Wuxi, Zhengzhou and Changchun generally sold at reserve prices, and the land auction mood was not high.

Fu Linghui, spokesperson of the National Bureau of Statistics and director of the National Economic Statistics Department, said that the centralized release of the backlog of housing demand in the first quarter led to an improvement in the real estate market. In the second quarter, the real estate market gradually returned to normal operation, and the real estate market generally showed a stabilizing trend in the first half of the year. In the future, investment in real estate development will still be at a low level. However, with the gradual adjustment of the real estate market, real estate development investment will gradually return to a reasonable level.

Some experts said that in the new stage of the real estate market, all parties can change their energy from "home ownership" to "home ownership is superior", promote residential development from single to diversified, promote the integration of production, housing and cities, focus on the future development of the industry, and promote the stable and healthy development of the real estate market.

Policies will be further optimized.

Recently, the Ministry of Housing and Urban-Rural Development held a corporate forum. The meeting pointed out that it is necessary to continue to consolidate the stabilization and recovery trend of the real estate market, vigorously support the demand for rigid and improved housing, and further implement policies and measures such as reducing the down payment ratio and loan interest rate for purchasing the first home, reducing taxes and fees for the purchase of improved housing, and "recognizing housing without repaying loans" for personal housing loans. Stabilizing the two pillars of construction and real estate plays an important role in promoting economic recovery.

Standard & Poor’s credit evaluation report believes that the bottleneck of the current real estate industry recovery lies in insufficient demand, and the recovery of demand depends more on the economy, per capita income level and the improvement of residents’ expectations for the future. "Only when residents’ employment and income can play a substantial supporting role in buying houses can the bail-out policy really take effect." Li Yujia, chief researcher of Guangdong Housing Policy Research Center, said. "In addition to various policies to continuously promote the property market to stabilize and improve, it is also necessary to form good market expectations and boost the release of rigid housing demand and improved demand." Zhao Xiuchi, president of capital university of economics and business Beijing-Tianjin-Hebei Real Estate Research Institute and executive vice president and secretary general of Beijing Real Estate Law Society, said.

Li Yujia said that the future policy orientation is to meet and release demand, such as meeting the needs of new citizens and young people to rent before buying; Revitalize the stock, improve the supply efficiency and match the demand, including the renovation of villages in cities, old residential areas and houses in counties and towns, so as to solve the problem of uncoordinated and insufficient development; Create a good house, a good community and a good community to meet the needs of beautiful living.

Zhao Xiuchi believes that all localities should combine the policy of having many children and the policy of introducing population to relax the purchase restriction policy appropriately. For example, further reduce the mortgage down payment ratio and mortgage interest rate, and allow the stock of fixed-rate mortgages to be converted into floating-rate mortgages based on LPR.

Zhang Bo predicted that in the second half of the year, the real estate regulation and control will be further optimized, and the probability of introducing policies related to the restriction and relaxation of purchase in hot cities may further increase. At the same time, the mortgage policy is expected to increase the inclination of improving demand.

At present, many real estate enterprises in the capital market are facing delisting. How can the financing environment of housing enterprises continue to improve in the future? Chen Xiao, a senior analyst at Zhuge Data Research Center, said that from the supply side, it is necessary to continue to increase financing support for housing enterprises and implement the "three arrows" support measures. "Financing should be more inclined to high-quality housing enterprises and private housing enterprises with stable funds."

Huang Yu suggested that we should continue to increase support for equity financing of listed real estate enterprises and speed up examination and approval; Supporting private housing enterprises to issue bonds by means of "cooperation between central and local governments" should be expanded and expanded, promoted in more cities, benefiting more private housing enterprises, and at the same time increasing support for mergers and acquisitions of listed housing enterprises.

The "Guiding Opinions on Actively and Steadily Promoting the Reconstruction of Villages in Megacities" deliberated and adopted by the executive meeting of the State Council on July 21st mentioned that in megacities, it is necessary to increase policy support for the reconstruction of villages in cities, actively innovate the transformation mode, and encourage and support the participation of private capital. Renovation of villages in cities and revitalization of idle assets will be important measures and ways to increase the construction and supply of affordable housing.

"In the next step, policy support such as developing affordable rental housing through multiple channels and taking multiple measures to stimulate social investment to jointly build affordable housing will be further enhanced." Zhang Bo said. (This article Source: Economic Daily Author: China Economic Net reporter Li Fang)

(Source: Economic Daily)