China Economic Net, Beijing, September 21-On the 17th, the central bank launched a one-year MLF (medium-term lending facility) operation of 265 billion yuan in the open market. As no liquidity instruments of the central bank expired, all the MLF funds were put into the market. After the central bank announced the MLF operation, a wave of media made an eye-catching interpretation: "Yang Ma released 265 billion yuan".

Is this really the case?

The article "Trader Chun Shenjun" pointed out that the central bank is called the bank of the bank. When the bank is short of money, it will borrow from the central bank for emergency. Open market operation is the means by which the central bank lends money to banks. Open market operations are divided into positive repurchase and reverse repurchase. Positive repurchase means that the central bank borrows money from banks to recover liquidity, while reverse repurchase means that the central bank lends money to banks to release liquidity. Every day, the reverse repurchase will expire, and the amount of operation MINUS the amount of maturity is the net investment. There is an index to measure the liquidity of funds: sentiment index of funds. When the index is greater than 50, it means that the funds are tight and the central bank needs to put in liquidity.

Image from trader Chun Shenjun’s article

According to the article, recently, due to the influence of centralized tax payment, the amount of funds in sentiment index has reached more than 60%, so the central bank put in funds to ease the market. "So, this is not what we understand ‘ Release water ’ Regardless of his hundreds of billions, it doesn’t matter how big the number is, because the money will be automatically recovered in a few days. "

The article bluntly said that a WeChat official account can pay no attention to it if it only talks about "releasing water" with open market data.

For the open market operation of the central bank, the "Lu political commissar’s worldview" made an image metaphor in the article: to a certain extent, the central bank is like managing a pool that pumps water while filling water, and the name of the pool is the interbank market. When the water level in the interbank market is too high, the administrator central bank needs to turn on the pump to pump water; When the water level is too low, the central bank needs to turn on the tap to inject water.

From September 1 to 11 this year, the central bank did not invest in the open market, but from December 12 to 18, the central bank began to increase investment, and the cumulative net investment scale reached 695 billion yuan. Why is there such a big change in the scale of delivery?

The article explains that when the liquidity is relatively stable at the beginning of the month, the necessity of central bank investment will decline; When paying taxes in the middle of the month to return liquidity, the central bank needs to increase the amount of "water replenishment" in the open market. When the issuance of local bonds increases, the central bank needs to "replenish water" moderately to hedge the impact of local bond issuance and payment; When the funds raised by local bonds are converted into fiscal expenditure, the central bank will reduce the investment accordingly to prevent the "water level" in the interbank market from being too high.

So, how to judge whether the central bank is "releasing water"?

According to the article "EBS Collection Research", it is not only the open market operation that determines the water level of this pool in the inter-bank market, but there are several pipes for both water inflow and water outflow. For example, the occupation of funds by local debt issuance, the change of foreign exchange holdings, the collection and payment of fiscal deposits, and so on. Whether the central bank is "releasing water" depends not on how many MLFs it has made, but on a key indicator: DR007.

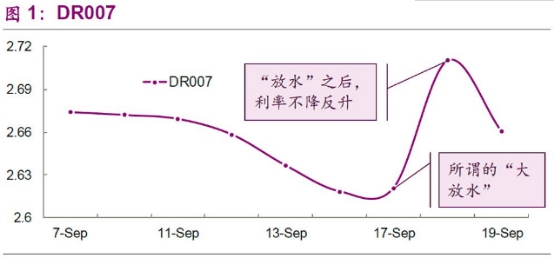

DR007 refers to the repurchase rate between banks and banks before. "Interest rate is the price of capital, just like the price of cabbage in the vegetable market. If there is a bumper harvest of cabbage, the price will definitely be low, which is the relationship between supply and demand. The price of funds is the same. If the People’s Bank of China releases water, then DR007 will definitely drop sharply. "

According to statistics, in fact, after the latest MLF operation of the central bank, DR007 did not decline. On September 14th, DR007 was 2.62%, and it was still 2.62% on the 17th. On the 18th, DR007 rose instead of falling, reaching 2.71%.

The picture comes from the public number of EBS fixed income research.

The article "Lu political commissar’s world outlook" also pointed out that while filling water and pumping water in the pool, how do you know whether the water level in the pool is appropriate? The interest rate of inter-bank funds is a very intuitive water level scale. In mid-September, although the central bank increased its efforts in the open market, DR007 remained relatively stable, with no obvious downward trend. Overall, since September, DR007 has fluctuated slightly around the center of 2.62%, reflecting that although the central bank’s investment has changed greatly, the "water level" of interbank liquidity is basically stable.