CCTV News:The National Bureau of Statistics released April CPI and PPI data on May 11th. The data shows that in April, consumer demand continued to recover, and CPI, the national consumer price index, rose by 0.1% month-on-month, and rose by 0.3% year-on-year, with a slight increase.

From the ring comparison, CPI changed from last month’s decline to 0.1%. In food, the market supply is relatively sufficient, and the prices of fresh vegetables, shrimps and crabs, beef, eggs and fresh fruits have declined.

Among non-food items, due to the increase in travel during the small holiday, the prices of air tickets, transportation rental fees, hotel accommodation and tourism all went up. Affected by the upward trend of international gold price and oil price, domestic gold jewelry and gasoline prices have increased.

From a year-on-year perspective, CPI rose by 0.3%, an increase of 0.2 percentage points over the previous month. Among them, the prices of pork and fresh vegetables turned from falling to rising year-on-year, while the price declines of fuel cars and new energy cars all narrowed.

He Xiaoying, deputy director of the Analysis and Forecasting Department of the Price Monitoring Center of the National Development and Reform Commission, said that from the same period of last year, China’s economy rebounded well, and the endogenous power continued to increase. The increase of core CPI excluding food and energy was larger than that of last month. Among the eight categories of goods and services that constitute CPI, except for food, tobacco and alcohol, the prices of the other seven categories have all increased year-on-year, and the recovery of consumer demand has been further consolidated.

In April, industrial production continued to resume, and the national industrial producer ex-factory price index PPI decreased by 0.2% month-on-month and 2.5% year-on-year, which was 0.3 percentage points narrower than last month.

Central Bank: RMB loans increased by 10.19 trillion yuan in the first four months of 2024.

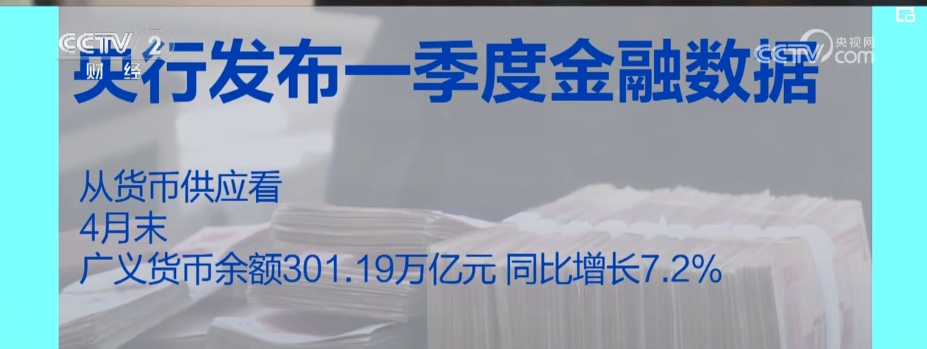

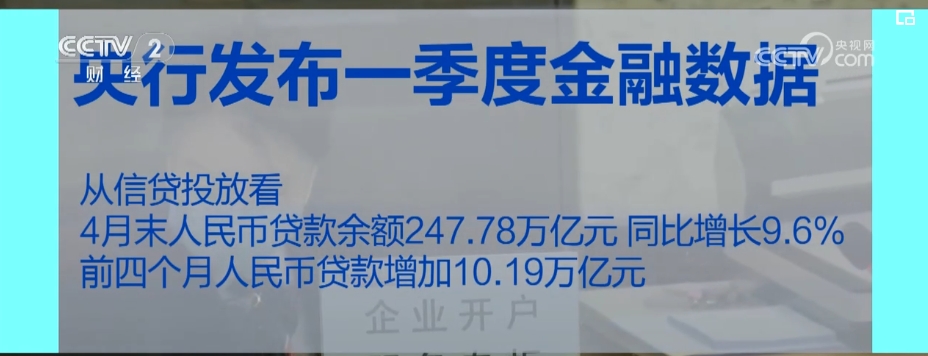

On May 11th, the central bank released financial statistics for April. Many indicators showed that the credit structure continued to be optimized and the interest rate remained low.

According to the data of the central bank, from the perspective of money supply, at the end of April, the broad money balance was 301.19 trillion yuan, a year-on-year increase of 7.2%.

In terms of credit supply, at the end of April, the balance of RMB loans was 247.78 trillion yuan, a year-on-year increase of 9.6%. In the first four months, RMB loans increased by 10.19 trillion yuan.

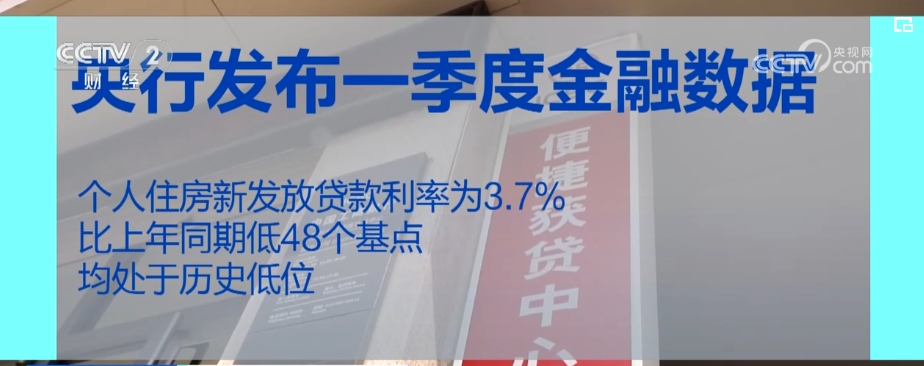

Central Bank: In April, the interest rate of new loans for enterprises and individuals remained at a historical low.

From the loan interest rate, in April, the weighted average interest rate of new loans issued by enterprises was 3.76%, 23 basis points lower than the same period of the previous year; The interest rate of new loans for individual housing is 3.7%, which is 48 basis points lower than the same period of last year, both of which are at historical lows.

Zhang Jun, chief economist of china galaxy Securities, said that the credit supply in April was in line with the current economic growth. In the first four months, various loans increased by 10.19 trillion yuan, a higher level in the same period in history. In previous years, the "roller coaster" phenomenon of credit supply caused by the "good start" of financial institutions was alleviated in 2024.

Central Bank: At the end of April, the stock of social financing scale was 389.93 trillion yuan, up 8.3% year-on-year.

Judging from the scale of social financing, at the end of April, the stock of social financing scale was 389.93 trillion yuan, up 8.3% year-on-year.

From the structural point of view, the growth rate of green loans and medium-and long-term loans in manufacturing industry remained at a high level of around 30%.

At the latest symposium on green finance held by the central bank and other four departments, the central bank said that the capital demand of green and low-carbon related industries is huge, and it is necessary to give full play to the role of green finance in optimizing resource allocation.

Pan Gongsheng, governor of the People’s Bank of China, said that developing green finance is an important direction to achieve high-quality financial development. At the end of the first quarter, China’s green bonds issued nearly 3.6 trillion yuan, and now the balance is 1.9 trillion yuan.

In April, the consumer price index rose by 0.3% year on year.

Data one:It rose by 0.3%. The National Bureau of Statistics released data on May 11th. In April, the national consumer price index (CPI) rose by 0.3% year-on-year, with an increase of 0.2 percentage points over the previous month. Among them, food prices fell by 2.7%, the same as last month, and non-food prices rose by 0.9%.

China’s balance of payments remained basically balanced in the first quarter.

Data 2:39.2 billion dollars. According to the latest data from the State Administration of Foreign Exchange, in the first quarter of 2024, China’s international payments remained basically balanced. Among them, the current account surplus was US$ 39.2 billion, accounting for 0.9% of the gross domestic product (GDP) in the same period, which remained in a reasonable and balanced range.

In April, the production and sales of new energy vehicles increased by over 30% year on year.

Data 3:35.9% and 33.5%. On May 11th, China Automobile Industry Association released data. In April, China’s automobile production and sales showed a rapid growth year-on-year. Among them, the production and sales of new energy vehicles maintained rapid growth. In April, 870,000 vehicles and 850,000 vehicles were completed, up by 35.9% and 33.5% respectively, and the market share reached 36%.