The two months in 2024 are fleeting. Just entering March, major new energy vehicle companies have announced their sales results in February. According to the latest data, Guangzhou Automobile’s sales volume in February was 16,676, compared with 30,086 in the same period last year, down 44.57% year-on-year, and down 33.15% month-on-month compared with 24,947 in January. It is not difficult to see that there has been a huge decline in both year-on-year and quarter-on-quarter, and it also showed a downward trend in January this year. In January, the sales volume of Ai ‘an was 24,947 vehicles, compared with 45,945 vehicles last month, that is, in December 2023, the sales volume dropped by 45.7%, almost half. This means that after entering 2024, the sales volume of GAC Ai ‘an has been declining for two consecutive months, and the total domestic and international sales volume in January and February is only 41,623, which is less than the level of 50,000 vehicles sold in the peak month last year.

The performance of this sales data of GAC Ai ‘an is really worrying. You know, in 2023, with the annual sales volume of over 480,000 vehicles, GAC Aian ranked among the top three manufacturers of new energy vehicles, second only to BYD and Tesla China, and compared with 271,000 vehicles in 2022, Aian achieved a year-on-year increase of 78% in 2023. Not long ago, Gu Huinan, general manager of Guangzhou Automobile Ai ‘an, said in an interview with the media that the annual sales of 500,000 vehicles is a "hurdle" for automobiles, and Guangzhou Automobile Ai ‘an hopes to cross this hurdle this year. The sales target for this year is to strive for 700,000 vehicles. This means that in 2024, the average monthly sales volume of GAC Ai ‘an will reach about 60,000 vehicles to achieve this sales target. However, judging from the sales trend in the first two months of this year, it is a bit difficult to complete this figure.

Undeniably, the competition in the domestic automobile market is very fierce now, and all major automobile companies are under great competitive pressure. In this fierce competition, Ai ‘an is facing not only the decline of sales volume, but also the double test of brand and market positioning. Founded in 2017, Ai ‘an, formerly known as Guangzhou Automobile New Energy, belongs to a branch of Guangzhou Automobile Passenger Car. With the rapid development of new energy automobile industry, Ai ‘an left Guangzhou Automobile Passenger Car in 2020 and officially declared its independence. The data shows that from 2018 to 2023, the annual sales volume of Ai ‘an was 20,000, 40,000, 60,000, 123,700, 271,000 and 480,000 respectively. It can be said that in just over six years, the achievements made by Guangzhou Automobile Ai ‘an are dazzling.

However, behind the high-speed growth, Ai ‘an also has an embarrassing worry. In the sales composition of Guangzhou Automobile Ai ‘an, online car rental accounts for a considerable proportion. According to the data, as early as 2021, 43% of the total sales volume of Guangzhou Automobile Ai ‘an came from the B-end sales market, in which the proportion of sales contributed by AION S at the B-end reached 63.01%, and the proportion of AION Y also accounted for 20.33%. As we all know, B-end is easy to load, but its disadvantages are also obvious, which is easy to pull down the product positioning and is not conducive to the later product volume. The car of Guangzhou Automobile Ai ‘an is considered to be sold only to the B-end market, and the ability of the product to enter the C-end market has not been verified.

Gac ean has also tried to turn things around. Since 2020, it has launched two models, namely AION V with a price of 159,900-232,900 yuan and AION LX with a price of 286,600-469,600 yuan. However, the sales volume has always been tepid, and the monthly sales volume of AION LX is even only a few dozen. It seems that it is difficult to break the deadlock. At present, AION S and AION Y are still the main sales models of Guangzhou Automobile Ai ‘an, but now, the sales of these two models have declined, which also directly affects the sales of Ai ‘an brand.

In addition, it is worth noting that there are also problems in the product layout of GAC Ai ‘an. The focus of Geely and Changan’s layout is in the range of 100,000-200,000 yuan, while GAC Ai ‘an is basically building a high-end brand Haobo throughout 2023. Especially in February this year, after BYD played the banner of "electricity is lower than oil", many car companies have taken official reductions or lowered the guide price of new models. According to Uncle Che’s incomplete statistics, at least 15 car companies or brands have introduced preferential measures such as "official reduction".

However, several models owned by Ai ‘an have only introduced some new models and the so-called free charging policy. For example, on March 3, an Ai ‘an AION Y Plus 310 Star Yao version was launched. Although the price dropped below 100,000 yuan, the pure battery life under CLTC condition was only 310km. In the new energy market in 2024, this endurance capacity was not competitive compared with competitors, and the related intelligent and comfortable configuration was also reduced. To tell the truth, compared with the cash discount of 20 thousand or even 30 thousand or 40 thousand for friends, these have no impact and competitiveness at all. At present, in 2024, the brand of Ai ‘an will not launch a particularly heavy and powerful new car one after another, so it is quite reasonable to encounter the sales dilemma.

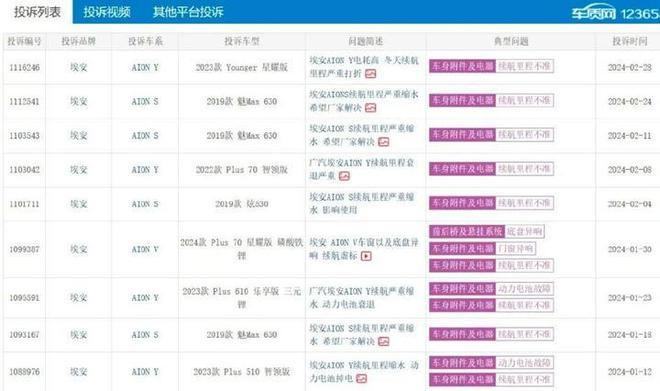

At the same time, Che Shu also found that in the past year, GAC Ai ‘an received the most complaints from users, and it was also the most popular model of GAC Ai ‘an. The most intensive complaint was that the cruising range was not allowed. However, the problem of inaccurate cruising range of models owned by Guangzhou Automobile Ai ‘an has been around for a long time. As early as 2021, users began to complain about AION Y on the automobile quality platform. The 500-kilometer battery life can only run 350 cars and get a 50% discount at high speed.

And not only AION Y, but also AION S occupies a very high proportion. In 2022, the scandal of "power-locking" broke out in Guangzhou Automobile Ai ‘an. Many owners of AION’s reported that the manufacturers locked the power privately through OTA upgrade without the consent of the owners, resulting in a general decrease in the cruising range of vehicles and a weakening of power, which seriously affected the normal car life of car owners and was questioned by consumers as "sales fraud" and "false propaganda".

Today, consumers’ consumption concept is becoming more and more mature and rational. Enterprises need to take their due responsibilities when problems occur, give consumers a satisfactory answer and solve them in time, which is the long-term way to survive. However, judging from the current complaints of GAC Ai ‘an, it seems that GAC Ai ‘an has not effectively rectified related problems. AION S and AION Y are the main sales force of GAC Aian. It can be said that if GAC Aian does not have AION S and AION Y, I believe its monthly sales volume will be even more ugly.

In this fierce competition, GAC Ai ‘an tried to transform its brand image by launching a brand-new high-end brand Hyper Haobo, in an attempt to find a new living space in the high-end market. In September, 2022, GAC Ai ‘an released Hyper Haobo, a high-end luxury brand. At present, there are three models on sale, namely Haobo SSR positioned as a sports car, Haobo GT (parameter picture) of a medium and large luxury car and Haobo HT of a medium and large SUV. Haobo GT and Haobo HT are the main sales models, and the price is between 21.39-33.99 million. However, the reality is not satisfactory. The market performance of these two models has not reached expectations, and the monthly sales volume is even more unsatisfactory.

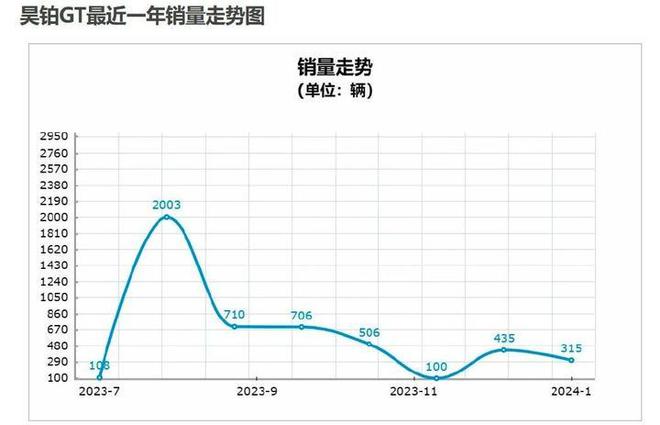

Take Haobo GT, its main sales model, as an example. Haobo GT was officially listed in July 2023. At the beginning of its release, GAC Ai ‘an called it "the trump card model" and declared at the press conference that "no car can shake the dominance of Model 3 until Haobo GT arrives". As the representative model of the 20 millionth new energy vehicle in China, it is a heavy model with high hopes, but from the current sales performance, the performance of Haobo GT is not very satisfactory.

From its listing in July 2023 to January 2024, Haobo GT only sold more than 2,000 vehicles in July 2023, and the sales in other months were less than 800 vehicles, even less than 500 vehicles in some months. Among them, in January 2024, the sales volume of Haoplatinum GT was only 315 vehicles, which was 27.58% lower than that of last month, almost 30% lower. Obviously, no matter from the perspective of sales scale or sales trend, the performance of Haoplatinum GT is not brilliant.

In 2024, the involution of the new energy vehicle market will intensify. Tesla has started to reduce the price. Extreme Krypton 007 has pulled the price of 800V high-voltage fast charging to around 200,000, while Galaxy E8 has pushed the price of B-class pure electric cars to around 170,000. GAC’s exploration in the mid-to high-end market seems to have met an invisible wall. In addition to traditional car companies, there are also brands such as Weilai, Tucki and Ideality that have been deeply involved in this field for many years, and have solid brand influence and product competitiveness. It is undoubtedly necessary for GAC Ai ‘an to take a slice of the Red Sea. In 2024, Yu Guangqi ‘an is destined to face a more severe test.

Che Shu concluded

Since 2023, the word "volume" has been running through. At first, Skyline, Aichi and Weimar were out of the game. Since 2024, Gaohe has also heard regrettable news. At the moment when the involution of domestic new energy vehicles is intensifying, consumers have more comparisons and choices, and it is difficult for major car companies to win the favor of consumers if they don’t show a little "hard power". In particular, Geely, Chang ‘an, Great Wall and many other domestic veteran car companies are rushing on the road of transformation, and they are constantly "competing" with each other, and each company has its own strengths. Whether in product innovation, brand building, market expansion or service improvement, GAC Ai ‘an needs continuous intensive cultivation. Facing the future, GAC Aeon needs both courage and wisdom. Only by constant adaptation and innovation can we keep a steady pace in this ever-changing market, otherwise the decline in sales and the loss of people’s hearts are also predictable results.