??important news

??China’s assets are boiling all over the place! The Nasdaq China Golden Dragon Index has soared by more than 9%, and the offshore RMB is approaching the 7 mark

On September 25th, the skyrocketing momentum of class A shares spread to popular Chinese stocks, and the Nasdaq China Golden Dragon Index continued to soar after gaping nearly 4%, maintaining a strong rise throughout the day, closing up 9.13%, the largest increase since the end of 2022 (the index closed up 9.62% on November 30, 2022). Boss Zhipin rose more than 19%, Bilibili rose more than 17%, Tencent Music rose more than 16%, Kingsoft Cloud, iQIYI rose more than 14%, Tiger Securities, JD.com, Dada Group rose more than 13%, XPeng Motors, NIU, Weibo, NIO, Li Auto, Dingdong Maicai rose more than 11%, Ctrip Group, NetEase rose more than 8%, Alibaba, New Oriental, Baidu, Parkson China rose more than 7%. CNBC mentioned that the Chinese government has taken measures to stimulate economic growth, and the Chinese stock market has performed well.

The sharp rise in Chinese assets also provided a significant boost to European stocks. Major European stock indexes closed higher, with Germany’s DAX index closing up 0.8%, France’s CAC 40 index closing up 1.28%, Britain’s FTSE 100 index closing up 0.28%, and the Eurozone STOXX50 index closing up 1.13%. Reuters analysis said that European luxury goods giants and automakers and other companies with operations in China led the gains, and mentioned that the Chinese central bank announced extensive monetary stimulus and real estate market support measures.

International oil prices rose on the 24th. As of the end of the day, light crude oil futures for November delivery on the New York Mercantile Exchange rose 1.19 US dollars to close at 71.56 US dollars a barrel, an increase of 1.69%; London Brent crude oil futures for November delivery rose 1.27 US dollars to close at 75.17 US dollars a barrel, an increase of 1.72%. Reuters said that news of monetary stimulus measures from China, the world’s largest crude oil importer, and concerns that intensifying conflicts in the Middle East could affect regional supplies, oil prices rose to recent highs.

Gold and silver prices rose significantly, as of press time, COMEX gold rose 1.12%, reported $2682.3/ounce, a record high; COMEX silver rose 4.41%, reported $32.455/ounce.

The US dollar index fell on the 24th. The offshore RMB rose 0.73% against the US dollar on the 24th to close at 7.0109, surging 513 points during the day, approaching the 7 key mark.

??Class A shares three major indexes collectively rose

Financial sector news on September 24th, in a series of policy combination fist, the three major indexes opened high. As of the close, the Shanghai Composite Index rose 4.15%, up 114.21 points, reported 2863.13 points; Shenzhen Composite Index rose 4.36%; growth enterprises market index rose 5.54%. Class A share traded 974.76 billion yuan throughout the day.

On the 24th, 5165 stocks of class A shares rose, 23 were flat, and 160 were down. 31 Shenwan-level industries were red across the board. Food and beverage (Shenwan), non-bank finance (Shenwan), steel (Shenwan), coal (Shenwan) and other industries were among the top gainers.

The financial sector strengthened across the board. Brokerage stocks broke out, Oriental Fortune rose 11.46%, Pacific, Capital Securities, Seawater Securities, Jinlong Shares, and Tianfeng Securities rose by the daily limit. 36 of the 51 brokerage stocks rose by more than 5%.

Insurance stocks and bank stocks all received dividends. Among insurance stocks, Tianmao Group rose by the daily limit, Xinhua Insurance rose by more than 8%, China Pacific Insurance rose by more than 6%, and China Ping An rose by more than 5%; among bank stocks, Bank of Communications and Changshu Bank rose by more than 6%, and Bank of Ningbo, China Merchants Bank, Shanghai Pudong Development Bank and Wuxi Bank rose by more than 5%.

On that day, the top ten stocks by turnover included Kweichow Moutai, Oriental Fortune, Changshan Beiming, CITIC Securities, Wuliangye, Ping An of China, Industrial Fulian, Baobian Electric, and China Merchants Bank. Among them, Kweichow Moutai had the highest turnover, exceeding 13 billion yuan, an increase of 8.8%; Ningde Times rose nearly 5%.

Zhang Yongzhi, deputy general manager of the fixed income department of Huashang Fund and manager of Huashang Steady Double Interest Bond Fund, said that the three departments collectively support the capital markets and inject liquidity funds into the stock market through multiple channels. State investment institutions, fund companies and other market institutions and listed companies are expected to receive sufficient liquidity support, which may provide better support for the stabilization and rise of the stock market.

Huafu Securities released a research report that this financial policy combination is of great significance to support the real economy and boost confidence in capital markets.

??The central bank announced: cut interest rates, cut interest rates, and reduce the stock of mortgage interest rates

On September 25, Qianlong.com reported that on the morning of September 24, the State Council Information Office held a press conference. Pan Gongsheng, Governor of the People’s Bank of China, Li Yunze, Director of the State Financial Supervision and Administration, and Wu Qing, Chairperson of the China Securities Regulatory Commission, introduced the situation of financial support for high-quality economic development and answered reporters’ questions. A number of weighty policies were launched at the same time to increase the intensity of monetary policy regulation and control to further support stable economic growth.

Point 1: Reduce the deposit reserve ratio and policy interest rate

In the near future, the deposit reserve ratio will be cut by 0.5 percentage points to provide long-term liquidity to financial marekt of about 1 trillion yuan; in this year, depending on the market liquidity situation, the deposit reserve ratio may be further reduced by 0.25-0 percentage points. Reduce the central bank’s policy interest rate, that is, the 7-day reverse repurchase operation rate, by 0.2 percentage points, from the current 1.7% to 1.5%, and guide the loan market quotation rate and deposit rate to decline simultaneously, to maintain the stability of the net interest margin of commercial banks.

Point 2: Reduce the interest rate of the existing mortgage and the minimum down payment ratio of the unified mortgage

Guide commercial banks to reduce the interest rate of existing mortgages to near the interest rate of newly issued loans, which is expected to decrease by about 0.5 percentage points on average. It is expected to benefit 50 million households, 150 million population, and reduce the average annual interest expenditure of households by about 150 billion yuan.

Unify the minimum down payment ratio for first and second suites, and reduce the minimum down payment ratio for second suites at the national level from the current 25% to 15%.

The central bank’s capital support ratio in the previously created 300 billion yuan affordable housing reloan will be increased from 60% to 100%, strengthening market-oriented incentives for banks and acquirers.

The two policy documents, operational property loans and "financial 16", which expire before the end of the year, will be extended until the end of 2026.

Point 3: Create new monetary policy tools to support the stable development of the stock market

The first is to create a securities, funds, and insurance company swap facility to support eligible securities, funds, and insurance companies to obtain liquidity from the central bank through asset pledges. This policy will greatly enhance institutions’ ability to obtain funds and increase their stock holdings.

The second is to create a special project for share repurchase and share increase, and guide banks to provide loans to listed companies and major shareholders to support share repurchase and share increase.

Point 4AIC’s equity investment pilot will be expanded to 18 cities

The State Administration of Financial Supervision will optimize the pilot policy for equity investment in financial asset investment companies (AICs).

First, the scope of the pilot will be expanded from the original Shanghai to 18 large and medium-sized cities with active technological innovation, including Beijing.

Secondly, the restrictions will be relaxed, and the restrictions on the amount and proportion of equity investment will be appropriately relaxed. The proportion of institutional investment in the balance sheet will be increased from 4% to 10%, and the proportion of investment in single Private Offering Funds will be increased from 20% to 30%.

Third, guide relevant institutions to implement the requirements of due diligence exemption and establish and improve long-term differentiated performance appraisal.

Point 5Treasury bond trading is included in the monetary policy toolbox

At present, the People’s Bank of China has included the purchase and sale of government bonds in its monetary policy toolbox and has begun to experiment with it.

Point 6Support the acquisition of real estate enterprises’ existing land

On the basis of using some local government special project bonds for land reserves, we will study and allow policy banks and commercial banks to lend to support qualified enterprises to purchase land in the market, revitalize the existing land, and ease the financial pressure of housing enterprises. When necessary, the People’s Bank of China can also provide re-loan support.

Point 7Multiple measures to promote the entry of medium and long-term funds into the market

The Securities Supervision Commission and other relevant departments have formulated the "Guiding Opinions on Promoting Medium and Long-term Funds to Enter the Market", which will be released in the near future, focusing on three measures:

The first is to vigorously develop equity-based public funds.

The second is to improve the institutional environment for "long-term investment".

The third is to continuously improve the ecology of capital markets.

Point 8The state plans to increase capital in six large commercial banks

After studying the national plan to increase core Tier 1 capital for six large commercial banks, it will be implemented in an orderly manner according to the idea of "overall promotion, phased and batch, one line, one policy". The State Administration of Financial Supervision will continue to urge large commercial banks to improve their refined management level and strengthen their high-quality development capabilities under capital constraints.

Point 9Further optimization of loan renewal policies for small and micro enterprises

Expand the loan renewal target from some original small and micro enterprises to all small and micro enterprises. Small and micro enterprises that have real financing needs after the loan expires and have financial difficulties can apply for loan renewal support if they meet the conditions.

Expand the loan renewal policy to medium-sized enterprises in stages, with a tentative term of three years, that is, for medium-sized enterprise working capital loans that expire before September 30, 2027, you can refer to the loan renewal policy for small and micro enterprises.

Adjust the risk classification standards, and renew the loans of enterprises with legal compliance, continuous operation and good credit, and do not reduce the risk classification separately due to the renewal of loans.

Point 10Securities Supervision Commission will issue six measures to promote mergers and acquisitions

In order to further stimulate the vitality of the M & A and reorganization market, the Securities Supervision Commission has studied and formulated six M & A articles on the basis of extensive research and listening to the opinions of all parties in the previous stage, that is, "Opinions on Deepening the Reform of the M & A and Restructuring Market of Listed Companies", adhere to the market direction, and better play the role of the main channel of capital markets in M & A and reorganization.

??domestic

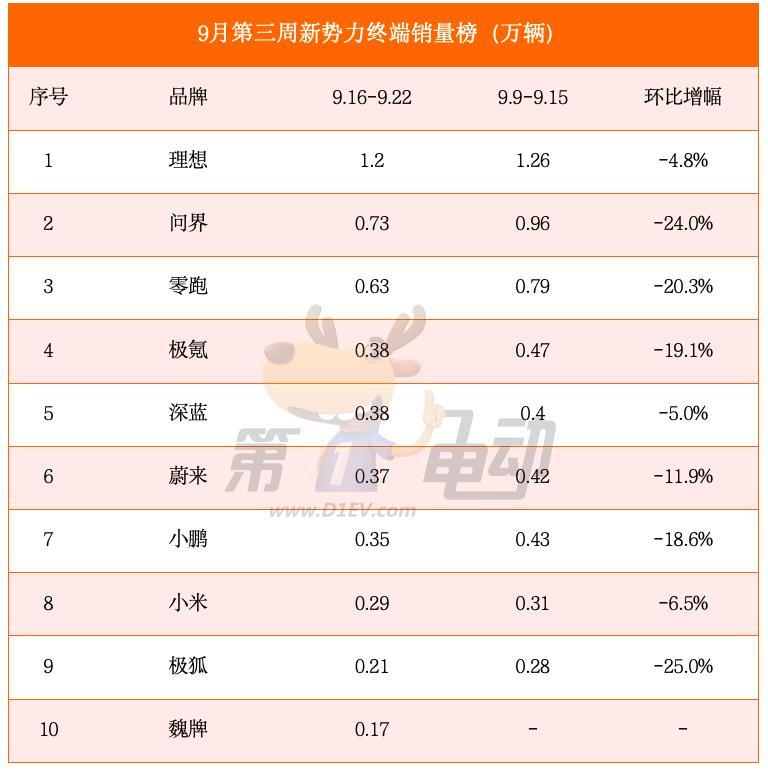

??Sales list for the third week of September: All TOP10 brands declined, and Xiaopeng, NIO, and Wenjie fell sharply

First Electric September 24th news, in the third week of September (9.16-9 22) new energy vehicle end point sales released. Affected by the Mid-Autumn Festival holiday and other factors, the Chinese auto end point market declined in the third week of September. TOP10 new energy/new power/luxury car brands all declined, including Lexus, Mercedes-Benz, BMW, Q Jie and other luxury car brands, as well as Zero Run, Ai’an, Extreme Fox sales fell by more than 20% month-on-month; Extreme Krypton, Xiaopeng, NIO, Tesla, Galaxy, Audi sales fell by more than 10% month-on-month. It is worth noting that, thanks to the price reduction promotion of ID.3, Volkswagen replaced Extreme Krypton on the list of new energy brands again; Wei brand replaced Dengshi and entered the top 10 of the new power list for the first time; Ideal once again surpassed BBA to win the second place in the luxury list.

??BMW China denies price cut rumors, maintaining recommended retail price unchanged

BMW China has denied recent rumors that it is withdrawing from the price war. BMW China said that the company has not adjusted the recommended retail price, and authorized dealers will decide the retail price according to market conditions. Previously, there were rumors that BMW may cut the price of models due to factors such as sales fluctuations, market pressure and increased competition. On September 11, BMW lowered its full-year profit margin forecast due to weak demand in the Chinese market and problems with the braking system of German auto parts supplier Continental, which caused BMW’s share price to fall to its lowest point in nearly two years. BMW expects deliveries to decline slightly this year, compared with previous expectations for a slight increase, and full-year EBIT margins are expected to be between 6% and 7%, down from 8% to 10% previously.

??August luxury car sales plummeted: BMW, Bentley and other brands saw an alarming decline

Fast Technology reported on September 24th that the domestic luxury car market suffered a decline in sales in August. Among the 30 luxury brands, only three brands, SAIC Audi, SMART and Polaris, achieved positive sales growth, while the other 27 brands saw sales decline year-on-year. BMW Brilliance sales fell 47.12% year-on-year, Cadillac fell 37.09%, and Infiniti fell 67.39%. Among the ultra-luxury brands, Bentley, Maserati, Ferrari, Rolls-Royce and McLaren all saw sales decline by more than 35% year-on-year. At the same time, the total domestic car sales rose by 8.5% month-on-month, but fell by 5% year-on-year. The decline in luxury cars far exceeded that of the mainstream car market.

Sales in the domestic luxury car market generally fell in August, with only three brands posting positive growth. BMW Brilliance sales fell 47.12% year-on-year, Cadillac 37.09% and Infiniti 67.39%. Ultra-luxury brands saw a sharper year-on-year decline, with Bentley, Maserati, Ferrari, Rolls-Royce and McLaren all exceeding 35%. Total domestic car sales rose 8.5% month-on-month, but fell 5% year-on-year, and the decline in luxury cars far exceeded that of the mainstream car market.

??GAC Trumpchi partners with Huawei to launch smart concept car 1 Concept in 2025

On September 24th, it was reported that GAC Trumpchi’s new concept car 1 Concept was officially released. The new car adopts Huawei’s smart car solution, equipped with Huawei Hongmeng cockpit and Qianhe Intelligent Driving ADS 3.0 system, and is expected to be listed in Quarter 1 in 2025. 1 Concept has a low-lying appearance. There are large-size interactive lights on the front face. LED daytime running lights run through the front of the car and are equipped with time-rotating shaft headlights. The streamline design on the side of the body, the length of the car is 5128mm, the width of the car is over 2000mm, and the wheelbase is 3000mm. It adopts short front and rear suspension and long wheelbase design. The Huawei ADS 3.0 system installed can realize the intelligent driving NCA from parking space to parking space. It arrives with one click. It supports leaving the car and can be parked in a very narrow parking space GAC Trumpchi and Huawei’s cooperative models will cover cars, SUVs, and MPVs, all of which are equipped with Huawei’s new generation of Hongmeng cockpit and ADS 3.0.

??Zhiji LS6 medium and large SUV newly upgraded, pre-sale 229,900

On September 25th, the Zhiji brand officially announced that the new Zhiji LS6 will be launched on September 26th. The pre-sale price range of this medium and large SUV is 22.99-29 9,900. The new car will be equipped with a digital chassis of the lizard, and will be upgraded in terms of appearance and smart driving. Zhiji also announced that the IM AD No Picture City NOA will be launched nationwide in October and will push all models. The new Zhiji LS6 has been adjusted in detail in the design. The headlights and fog lights are more minimalist, the front surround is redesigned, and the tail is equipped with a through taillight group and a ducktail shape to enhance the sense of sports.

??Geely Galaxy E5 sales break 20,000, capacity upgrade to meet demand

On September 24th, Geely Galaxy held a question-and-answer activity for its latest model Galaxy E5, responding to a number of consumer concerns. The official confirmed that only users who have opened the VIP service can enjoy the complete experience of 16 speakers of the Flyme Sound sound system. Regarding the question of the priority of small-order users to pick up the car, the official explained that although small-order users enjoy priority, the actual pickup time is still affected by many factors. Since the launch of the Galaxy E5, the market has responded enthusiastically, and the delivery volume has exceeded 20,000 within 45 days. The founder of Geely personally delivered the key for the 20,000 owner. In order to meet the growing market demand, the factory of Galaxy E5 completed a two-week capacity upgrade in September, and it is expected to be able to fully meet the delivery demand in October.

??Huawei Smart R7 pre-sale starts

First Electric reported on September 24th that Huawei announced the pre-sale of the Smart R7 at the autumn all-scene new product launch conference, which is expected to be launched soon. The Smart R7 is the second model cooperated by Huawei and Chery. It is positioned as a medium and large coupe SUV. The pre-sale price starts from 268,000 yuan, which is comparable to the Tesla Model Y. In design, the Smart R7 adopts a front face similar to the M9, and has the lowest wind resistance coefficient in the world’s mass-produced SUVs. The car adopts a yacht-style environmentally friendly cockpit design, equipped with a screen and a heating and cooling refrigerator. The co-pilot has a zero-gravity seat, and the rear leg space is about one meter. The seat has ventilation, heating and massage functions.

In terms of intelligence, Zhijie R7 is equipped with Hongmeng Zhixing system to enhance the intelligent interaction experience. The power system adopts 800V high-voltage SiC drive motor and 800V fast charging architecture, with a maximum battery life of 802 kilometers. The pre-sale of Zhijie R7 starts from 268,000 yuan. With performance, intelligent technology and comfortable experience, it is expected to become a market competitive product.

??Geely Star Wish pure electric car pre-sale opens: 78,800, battery life 310-410km

Fast Technology September 24th news, Geely Automobile launched a new pure electric car Star Wish, pre-sale price range of 7.88-10 7,800 yuan. The new car adopts a new design language, providing seven car color options, body size is 4135 * 1805 * 1570mm, wheelbase 2650mm, positioning small car. In terms of power, Star Wish provides two single motor power, with a maximum output of 79 horsepower and 116 horsepower, equipped with Ningde Times battery core and liquid-cooled temperature control system, battery life is divided into 310km and 410km two versions, support 1.66C maximum charging rate, 30-80% fast charging time 24 minutes, 10 minutes to supplement the battery life of 120km.

The launch of Geely Star Wish will further enrich Geely’s layout in the pure electric car market, competing with BYD Seagull, Dolphin and other models.

??Haobo NDA3.0 Upgrade: A New Breakthrough in National Autonomous Driving

On September 24th, according to official news, Haobo will push the NDA3.0 system update on September 30th, aiming to improve the recognition and intelligence level of vehicles. This update involves models such as Haobo HT, Haobo GT and Tyrannosaurus Rex single lidar version. NDA3.0 processes information through a single neural networks, reducing losses during transmission and improving the ability to understand complex scenes. The technology can provide a stable driving experience in changeable environments, including complex situations such as backlighting at night and construction sections. Haobo NDA3.0 can also accurately identify and bypass special-shaped obstacles, such as cartons, stones, etc., and flexibly handle the traffic intentions of vehicles and pedestrians on congested road sections. Haobo is committed to promoting smart driving technology, has gained access to the L3 market, and plans to achieve large-scale production of L4-level technology by 2025.

??Changan Qiyuan A07 True Fragrance Edition will be ordered on September 26 and upgraded to L2 + assisted driving.

According to Changan Automobile, the new Changan Qiyuan A07 True Fragrance Edition will be available for pre-order on September 26. This medium and large sedan is the new work of Changan Automobile in this market segment, and the price range of the current model is 13.59-17 6,900 yuan. The whole system comes standard with L2 + level driver assistance system, equipped with IACC intelligent pilot function, front-facing camera is upgraded to 800W pixels, and the UI interface is optimized. The pre-sale price is expected to be the same as the current model, starting at about 135,900 yuan.

??BAIC New Energy cuts production capacity by 200,000 vehicles

On September 24th, it was reported that BAIC New Energy announced that it will adjust its production capacity from 320,000 to 120,000 vehicles and cut 200,000 vehicles to optimize the production capacity of new energy vehicles and focus on high-end manufacturing. BAIC New Energy’s production capacity includes 120,000 vehicles at the Miyun plant and 150,000 vehicles at the Zhenjiang base of Jichu. In recent years, the company’s sales have a big gap with the peak period. The sales volume in 2022 and 2023 are about 50,200 and 92,200 vehicles respectively. The cumulative sales volume in the first eight months of this year is about 52,000 vehicles, an increase of 12% year-on-year, but there is still a gap compared with competitors such as BYD. BAIC Blue Valley has suffered continuous losses since 2020. The net losses from 2020 to 2023 were 6.48 billion yuan, 5.24 billion yuan, 5.47 billion yuan and 5.40 billion yuan, respectively. The net loss in the first half of this year reached 2.57 billion yuan, and the cumulative loss in four and a half years reached 25.161 billion yuan.

BAIC New Energy is making every effort to build three major brands: Jihu, BEIJING and Xiangjie. Among them, Xiangjie S9 is regarded as the key to whether the company can return to the top. Xiangjie S9 connects to Huawei’s ecosystem through Huawei’s smart selection model, obtains technological upgrades, and uses Huawei’s sales channels to expand market entry. In the context of intensified market competition, it remains to be seen whether BAIC New Energy can turn losses and profits through cooperation with Huawei.

??Tesla Model 3 automatic parking failure, staged a "escape" drama

Fast Technology reported on September 24th that the incident of domestic new energy vehicles accidentally running to the road during automatic parking has attracted widespread attention, but car companies have not yet announced the detailed reasons. At the same time, a similar incident has also occurred in the United States, involving a Tesla Model 3. Surveillance video shows that a female driving Model 3 arrived at the door of her house. After using her mobile phone to activate the unmanned automatic parking function, the vehicle began to try to reverse and enter the yard. However, the vehicle suddenly stopped when it was about to complete the parking, and then continued to move forward and turned right to the road. The female owner tried to stop the vehicle, but the vehicle instead accelerated to flee. The final result is unknown because the camera failed to capture the follow-up situation. netizens joked whether this is an AI awakening, but considering that the vehicle can be controlled through the mobile phone, it should not be too much of a problem.

??Millet car 1.3.0 update, intelligent driving function fully upgraded

On September 24, Xiaomi Automobile released the 1.3.0 version of the software update, introducing a number of intelligent driving function optimizations and innovations. The update includes the enhancement of the "small road traffic" function, which improves the environmental modeling ability and can identify and handle complex road conditions more finely. Longitudinal functions have also been optimized, allowing vehicles to decelerate or avoid when facing reverse vehicles, pedestrians, etc. In addition, the intersection speed limit logic and lane selection logic have been optimized to improve the efficiency of passing through intersections.

??Ledao L60 went on sale for 72 hours: orders were full, and Tesla became the main competitor

Fast Technology September 24th news, NIO’s sub-brand L60 listed last week, providing rental services, starting at 149,900 yuan, the market response was enthusiastic. Although the official did not announce the specific order volume, but the founder of NIO and Ai Tie Chengdu said that the new car orders have increased significantly. According to car blogger Sun Shaojun, within 72 hours of the launch of the new car, 160 to 180 new orders were added to each store, the conversion rate of pre-sale orders was between 30% and 35%, and the number of customers entering the store increased by 700% to 800%.

At present, the total number of Ledao channels is about 150 to 200. Weekends are the peak for entering the store, and test drives need to be queued. Most of the car buyers are pure family users around 30 years old, and the replacement ratio is 50% to 60%. 70% of customers choose the battery rental plan. In terms of configuration choices, 90% of users choose rear drive and standard battery life (60kWh), with polar silver as the mainstream color. In the competitor comparison, 60% of customers consider Tesla Model Y, and northern users consider the ideal L6 more. Choosing Ledao L60 mainly focuses on its space and power exchange capacity.

??SAIC-GM-Wuling unveils ASEAN strategy

On September 24, SAIC-GM-Wuling held an ASEAN strategy conference in Nanning, which will become the first Chinese auto company to build in Indonesia. The first phase of investment is 1 billion US dollars, and the first phase of production capacity is 120,000 vehicles. It is expected to drive the development of 70 Indonesian **. At present, the company has achieved exports to more than 104 countries and regions. As of August 2024, the global cumulative exports exceeded 1.07 million units, and the overseas cumulative export amount reached 46.516 billion yuan.

??international

??Potassium metal battery breakthrough: Northeastern University develops stable anode for over 2,000 hours

On September 24th, Gaishi Automotive News, according to the journal eScience, researchers at Northeastern University and their collaborators have made a breakthrough in the field of potassium metal batteries (PMB). They have developed a hybrid interface layer rich in KF/Zn, which can effectively improve the electrochemical performance of potassium metal anodes and extend cycle stability to more than 2000 hours. This innovative method solves the problem of uncontrolled branch growth and interfacial instability in PMB by improving the transport kinetics of ions and electrons, paving the way for the commercial application of potassium metal batteries.

??Northvolt cuts 20% of its global workforce, increases production at its Swedish factory to cope with financial pressure

Northvolt, the European battery industry leader, announced on the 24th September that it would cut 20 per cent of its workforce globally in response to financial pressures. The company has cut 1,600 employees in Sweden, accounting for 25 per cent of its local workforce. Northvolt plans to scale back spending on other projects and focus on ramping up battery production at its Schelefteo plant in northern Sweden to increase revenue.

Northvolt faces challenges including technical issues with capacity, slowing demand for electric vehicles and increased international competition. The company is seeking 7.50 billion Swedish krona (about $737 million) to cover September salaries. This follows BMW’s cancellation of its 2 billion contract with Northvolt due to delivery quality issues, while Volkswagen also expressed dissatisfaction with Northvolt’s delivery speed. Nonetheless, Volkswagen reiterated its continued support for Northvolt, and BMW expressed its trust in the company.

??The number of electric vehicles in Norway has exceeded that of gasoline vehicles for the first time

According to data released by the Norwegian Road Federation (OFV), Norway has become the first country in the world to have more electric vehicles than gasoline cars. Of the 2.80 million passenger cars registered in Norway, 26.3% are slightly higher than gasoline cars at 26.2%. Diesel cars account for 35% and remain the most common model. The number of passenger cars in Norway is expected to increase to 3.10 million by 2030. Norwegian government incentives, such as exempting electric vehicle sales and emissions taxes and reducing tolls and parking fees, have promoted the popularity of electric vehicles. Of the 11,114 cars sold in Norway in August, electric vehicles accounted for 94%.

The Norwegian government wants to end sales of all new petrol and diesel cars by next year. Diesel car sales have soared since the tax benefit was introduced in 2007, but have fallen since peaking in 2017 as the electric car market has grown. In September, the number of diesel cars on Norway’s roads fell below 1 million for the first time.

Globally, about 18 per cent of new cars last year were electric. Electric cars and trucks accounted for 22 per cent of new vehicle sales in China, 14 per cent in Europe and 7 per cent in the US. While global EV sales are growing rapidly, growth in the US has fallen short of expectations, in part because of lagging charging networks and cooling consumer enthusiasm.

??LG Chem signs battery material supply agreement with Toyota Panasonic joint venture

LG Chem has signed a supply agreement for cathode active materials (CAM) for electric vehicle batteries with Prime Planet Energy & Solutions (PPES), a joint venture between Toyota and Panasonic. Under the agreement, LG Chem will supply CAM to PPES ‘Japanese plant from 2026, but the specific supply volume has not been disclosed. The partnership is part of LG Chem’s expansion strategy and aims to develop in tandem with PPES’ electric vehicle battery strategy.

Founded in 2020, PPES has grown rapidly, with a third battery factory in China announced in 2022. Toyota’s joint venture carries the automaker’s international EV goals. In 2022, Toyota decided to invest up to 730 billion yen (about $5.60 billion) to produce EV batteries in Japan and the United States, with the project scheduled to start between 2024 and 2026.

??Philippine auto market sales rose 7% in August, with Toyota leading the way

New vehicle sales in the Philippines rose 7% year-on-year to 39,155 vehicles in August from 36,714 in the same period last year. Cumulative vehicle sales in the Philippines rose 10% to 304,765 units in the first eight months of this year. Commercial vehicle sales rose 9% to 224,438 units, and passenger vehicle sales rose 14% to 80,327 units. Toyota led with 140,654 units, followed by Mitsubishi, Ford, Nissan and Suzuki.

Growth in the Philippine car market was driven by strong domestic economic activity. Gross domestic product grew 6.3 per cent year-on-year in the second quarter, while household spending growth was steady at 4.6 per cent. The government’s zero-tariff programme has added cars and local automakers plan to introduce more hybrid models.

??Geely Automobile partners with Tasco in Vietnam to build a factory and start production in 2026

According to a report on September 24, Vietnamese company Tasco signed a cooperation agreement with Geely Automobile Group to establish a joint venture car assembly plant in Taiping Province, Vietnam. The factory will use the form of CKD to assemble cars. The first annual production capacity is expected to be 75,000 vehicles, mainly assembling Lynk & Co and Geely brand models, and is expected to expand to other brands. The total investment of the project is about 168 million US dollars, with Tasco contributing 64% and Geely Automobile Group contributing 36%. Construction is expected to start in the first half of 2025 and the first models will be delivered in early 2026.

The partnership between Tasco and Geely Automobile Group will not only serve the Vietnamese market, but also plan to export to countries with which Vietnam has signed free trade agreements. Vietnam has previously attracted more investment from Chinese carmakers such as Chery Automobile and BYD.

??Zero Auto goes public in Europe and partners with Stellantis Group to expand its global market

On September 24th, Zero Auto announced that its C10 and T03 models were launched in Europe, and held a global media test drive event in Milan, Italy, officially entering the European market. The two models have been sold in 13 European countries including France, Germany, Greece, Italy. Zero Auto plans to expand its global sales channels to 350 in the fourth quarter of 2024, of which more than 200 will be sold in the European market.

In October 2023, Zero Auto and Stellantis Group established a global strategic partnership to jointly promote electric vehicle projects. The two parties jointly established Zero International Joint Venture, with Stellantis Group holding 51% of the shares and Zero Auto holding 49% of the shares.

??The European automotive industry faces new energy competition and Euro 7 emissions challenges

The European car industry is facing competition from China’s new energy vehicles and the upcoming Euro 7 emissions standards, IT House reported on September 24. The new standards will reduce the carbon dioxide emissions of new cars from 116 grams to 93 grams, and there will be heavy penalties for exceeding the standards. In response to the challenge, European automakers have invested 70 billion euros to develop new electric vehicle platforms and products, and electric vehicle sales will increase from 1% in 2018 to 15% in 2023. But Germany’s removal of incentives for electric vehicles and negative consumer sentiment has led to a slowdown in sales growth. Possible solutions include joining the CO2 pool, lobbying the European Union Commission to relax emissions targets or refocusing electric vehicle sales. However, these are only short-term solutions, and in the long term, automakers need more effective strategies to meet Euro 7 emissions standards. European automakers are challenged to find innovative and sustainable solutions to competitive pressures and emissions requirements as they pursue stricter Euro 7 emissions standards. As the electric vehicle market matures and consumer acceptance changes, automakers need to adjust their strategies to avoid significant fines and remain competitive.

??Volkswagen faces layoffs, unions demand job security

German union IG Metall has asked Volkswagen AG to keep all its plants in Germany and sign a new job guarantee agreement, Reuters reported on September 24. The union’s talks with Volkswagen are set to begin on September 25. The IG Metall union has called on workers to take part in demonstrations ahead of the talks, with leaflets accusing Volkswagen Group CEO Oliver Blume and Volkswagen brand manager Thomas Schaefer of preparing tombstones for the plants. It follows reports that Volkswagen Group could cut up to 30,000 jobs in Germany to improve competitiveness. The cuts mostly concern the research and development department, where between 4,000 and 6,000 of 13,000 research and development workers are expected to lose their jobs. Volkswagen’s labor council has denied the figure. Volkswagen Group Chief Financial Officer Arno Antlitz said that due to the weakness of the European market, the company lost 500,000 sales, and sales are not expected to recover immediately. It must cut expenses and adjust production to adapt to the transition to electric vehicles.

??Solid-state battery research requires standardized protocols

On September 24th, Galaxy Automotive reported that researchers from the University of Bayreuth published a report in the journal "Natural Energy" that despite billions of dollars invested in solid-state batteries worldwide, there is no uniform standard yet. Solid-state or all-solid-state batteries (ASSB) are expected to significantly increase energy density compared to traditional lithium-ion batteries and are seen as key to future electric vehicle energy storage systems. However, due to the lack of standardized protocols, the results of different research teams are difficult to compare. The researchers propose that a starting point needs to be established to achieve repeatability and comparability of battery cell tests, thus helping to reliably evaluate the innovation of this technology.