On March 19, Xiaomi Group announced its first annual report after listing, which also means that Lei Jun and Dong Mingzhu’s "1 billion bet" will be won and lost.

According to the annual report, Xiaomi achieved a total revenue of 174.915 billion yuan in 2018; previously, Gree said in the performance forecast that the total revenue in 2018 was between 200 billion and 210 billion yuan. Even according to the lower limit of Gree’s revenue, Lei Jun will still lose this "huge bet" by more than 25 billion yuan.

On March 20, when asked about the outcome of the "1 billion bet", Lei Jun replied: "I haven’t seen Gree’s official financial report, and she (Dong Mingzhu) has contacted me." At the opening of the market today, Xiaomi’s share price plunged after a slight increase of 0.82%. As of the closing price of 11.64 Hong Kong dollars per share, a decline of 4.59%. The latest market value is 2785.38 billion Hong Kong dollars.

mixed happiness

Xiaomi hands over its first annual report since going public

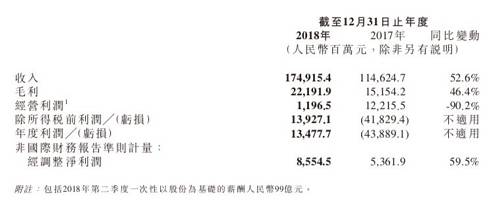

Xiaomi’s financial report shows that in 2018, Xiaomi Group’s revenue was 174.915 billion yuan (RMB, the same below), an increase of 52.6% year-on-year; adjusted Xiaomi Group’s net profit was 8.55 billion yuan, an increase of 59.5% year-on-year, higher than the 8.25 billion yuan expected by the market.

|

|

In addition, Xiaomi’s internet services, IoT and consumer products businesses all grew significantly, with total revenue of 16 billion yuan and 43.80 billion yuan respectively last year, growing by 61.2% and 86.9% respectively.

In addition, Xiaomi’s internet services division increased by 61.2% year-on-year, contributing revenue of RMB 16 billion for the year. The revenue of the IoT and consumer products division was RMB 43.80 billion, an increase of 86.9% over last year.

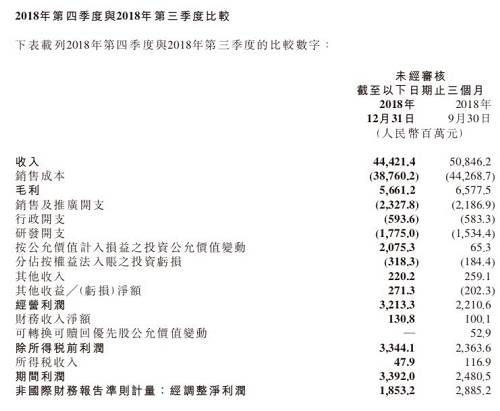

"We can finally proudly hand in our first full-year answer sheet," Lei Jun said in an open letter to investors. However, the financial report also showed that the fourth quarter of Xiaomi Group last year was actually "a little bad". In the fourth quarter of 2018, Xiaomi Group’s revenue was 44.40 billion yuan, down 12.6% from the previous quarter, and its operating profit totaled 1.853 billion yuan, down 35.8% from the previous quarter.

Specifically, various business sectors also performed poorly in the fourth quarter. In particular, Xiaomi mobile phones, which are the main revenue force, performed poorly. In the fourth quarter, Xiaomi mobile phone shipments were about 25 million units, down 12% year-on-year, and the gross profit margin of the smartphone division fell from 8.8% in 2017 to 6.2%. In this regard, Xiaomi attributed the "product portfolio adjustment and change in product launch schedule" in the financial report.

|

|

Miss Dong and Rebs have already left separately

With the announcement of Xiaomi’s 2018 financial results, Lei Jun and Dong Mingzhu’s "1 billion bet" finally came to an end. In December 2013, the two participated in the "China Economic Person of the Year" organized by CCTV and jointly presented the award. Lei Jun took the initiative to tell Dong Mingzhu that within five years, if Xiaomi’s turnover can beat Gree, "then please prove that Dong Mingzhu Dong Zong lost me one yuan." Dong Mingzhu responded domineering, what is a good bet for a dollar? If you want to bet, you can bet one billion yuan.

At that time, Xiaomi’s momentum was strong, and this competition was full of suspense, which was a great deal of interest for the market. Data show that its revenue in 2013 was about 31.60 billion yuan, and Gree’s revenue was 120 billion yuan. Can the rising star of the Internet succeed in overtaking the big brother of the manufacturing industry? With the "1 billion gambling" becoming a hot topic, Lei Jun and Dong Mingzhu have also talked about it in public many times.

In December, during the 2018 annual meeting of Chinese business leaders, Dong Mingzhu said in an interview that Gree had basically won the bet, and because Gree is doing the real economy and Xiaomi’s Internet business is light on assets, the two are not comparable, and the gamble itself is not meaningful. But she also pointed out meaningfully: "At that time, the bet was based on different concepts. If we all gave up heavy assets, then light assets would not exist. The state emphasizes that the economy cannot be divorced from reality to fiction, and these four words are enough to explain the win or lose."

WeChat official account "Chang’an Street Governor" once analyzed that Gree and Xiaomi, one is a national leading brand of traditional manufacturing, and the other is the darling of the new economy in the Internet field. The competition between these two star companies is actually a kind of healthy competition, which will bring more innovation and development to enterprises and industries.

Now that five years have passed, Xiaomi and Gree seem to be gradually approaching each other on their respective paths. After starting with mobile phones, Xiaomi’s trend of diversified development has become more and more obvious. In July and December 2018, respectively, it launched Mijia Internet air conditioner and Mijia Internet washing and drying machine, expanding its business to Gree’s battlefield. Gree also began to target Xiaomi’s territory, releasing the first generation of smartphones in March 2015. Despite the poor sales, Dong Mingzhu did not admit defeat: "The outside world is talking about the failure of Gree’s mobile phone business, but in fact we have not fully disclosed it in the market yet."

The end of the "bet" may not matter to Dong Mingzhu and Lei Jun. They are both good at taking a longer-term view and setting "small goals" for the future development of the company. Lei Jun said in 2018 that he would lead Xiaomi to return to the top of the domestic market in the next 10 quarters and double the profits of investors who bought Xiaomi shares on the first day of listing. In November 2018, Dong Mingzhu said that according to the deployment, the operating income of Gree Electric Appliance (000651) will reach 600 billion yuan by 2023.

This also means that the future of millet and Gree’s battlefield will continue to overlap, this long-lasting battle is far more attractive than the "1 billion bet". 36Kr pointed out in the report that from the moment when mobile phone manufacturers and home appliance manufacturers have turned their attention to IoT, Internet of Things, and smart home, millet and Gree are destined to meet, which will be a more serious and cruel story than the "1 billion bet".

"Caijing" new media comprehensive collation, part of the content comes from Tiger Sniff, First Financial, 36Kr

This article was first published on WeChat official account: Finance and Economics. The content of the article is the author’s personal opinion and does not represent the position of Hexun.com. Investors operate accordingly, and please bear the risk.