1905 movie network feature "This part of Disney China’s finances will not be profitable for 10 to 20 years."

In May 2016, Wanda Group chairperson Wang Jianlin publicly challenged Disney. At that time, Wanda Group was a huge commercial aircraft carrier that integrated cultural tourism, real estate, film and television content creation, film screening, and other businesses.

Seven years later, Wang Jianlin chose Zhuangshi to break his wrist in order to raise the repurchase money for the gambling agreement between his Wanda Commercial Management and investors. After the annexation of Wanda Film, the helm of Wanda Film was about to change hands.

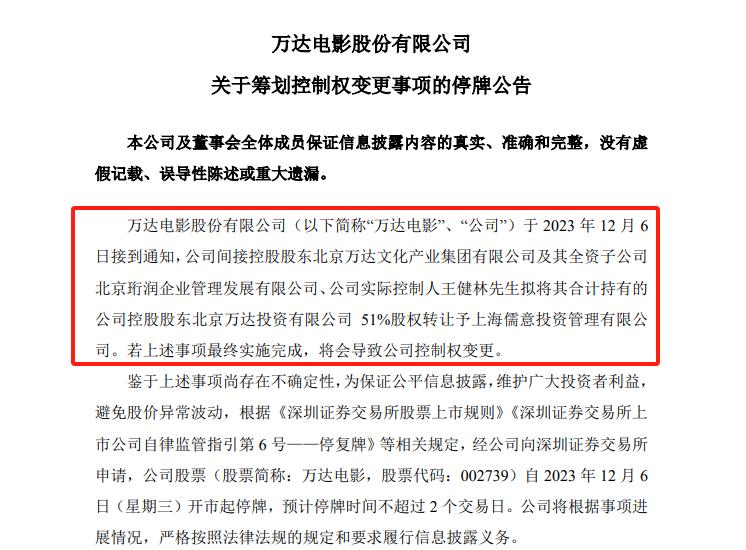

At noon on December 6, Wanda Film announced that Wang Jianlin, the actual controller of the company, plans to transfer his total 51% stake in Beijing Wanda Investment to Shanghai Ruyi Investment Management Co., Ltd. If the above matters are finally implemented, it will lead to a change in the company’s control.

According to the official account, in view of the uncertainties in the above matters, in order to ensure fair information disclosure, safeguard the interests of investors, and avoid stock market fluctuations, Wanda Film has suspended trading since the opening of the market on December 6, and is expected to suspend trading for no more than 2 trading days. As of December 12, Wanda Film securities are still suspended.

For both parties to the transaction, this may be a win-win deal.

Shanghai Ruyi may become the largest shareholder of Wanda Film

The mountains and rains are about to come and the wind is full of buildings.

In early November, a Wanda employee broke the news to the media that Chen Zhixi, the president of Ruyi Film, led a team to Wanda Film and Television for "research". At that time, there was a lot of speculation that Wanda Film and Television might be taken over by Ruyi Film.

On December 6, with an announcement from Wanda Film putting boots on the ground, rumors developed in the direction of prophecy. This is not the first time the two sides have cooperated.

In July 2023, Wanda Film issued a "Reminder Announcement on Changes in Indirect Controlling shareholders’ equity". The announcement shows that Shanghai Ruyi intends to buy 49% of Beijing Wanda Investment Company for 2.262 billion yuan and settle in Wanda Film through indirect holding.

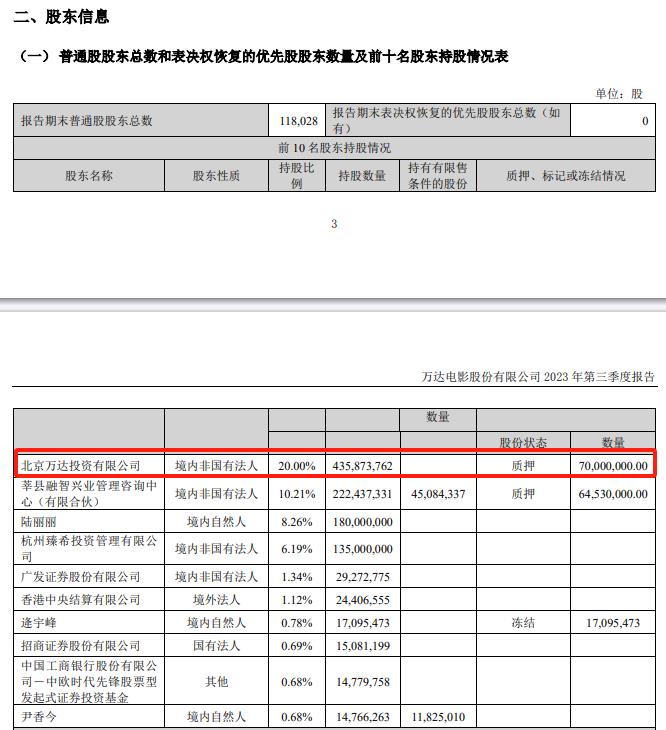

After the transaction was completed, Shanghai Ruyi held 2,13,578,143 shares of Wanda Film Company through Beijing Wanda Investment, accounting for 9.8% of the company’s total share capital. At that time, Wanda Film’s actual controller was still Wang Jianlin.

If the second transaction between the two parties is completed, Beijing Wanda Investment will become a wholly-owned subsidiary of Shanghai Ruyi. Shanghai Ruyi will hold 20% of Wanda Film’s shares through indirect shareholding, surpassing Wang Jianlin to become the company’s largest shareholder. According to Wanda Film’s closing price of 12.45 yuan/share before the suspension, Shanghai Ruyi needs to pay Wanda Film 2.767 billion yuan for the transaction.

The lack of money has become the main reason for Wanda Group’s self-rescue. From April 2023, Wanda Film will cash out by reducing its holdings and transferring shares to meet "its own capital needs".

In mid-April 2023, Wanda Investment announced that it would plan to reduce its holdings of Wanda Film through centralized bidding mode and block trade to no more than 65.38 million shares, accounting for 3% of the company’s total share capital, with a market value of about 953 million yuan.

In July this year, Wanda Investment transferred its 180 million Wanda Film shares to Lu Lili, the proprietress of Oriental Wealth, through an agreed transfer, accounting for 8.26% of Wanda Film’s total share capital. The transfer price is 12.07 yuan/share, and the total transaction amount is 2.173 billion yuan.

It is worth mentioning that 2023 is the last year of the listing period for Wanda Commercial Management and investors. In June 2023, Wanda Commercial Management submitted its IPO application to the Hong Kong Stock Exchange for the fourth time. Now the deadline for gambling is less than 20 days. If it fails to list on time, Wanda Film will not only need to buy back 30 billion yuan of equity, but also pay an annualized interest of 12%.

In addition, due to the rapid recovery of the Chinese film market in 2023, Wanda Film’s choice to trade at this time is also conducive to getting a high offer.

According to Wanda Film’s third quarter financial report in 2023, with the accelerated recovery of China’s film industry, the operating performance of the company’s various business segments has achieved significant growth compared with the same period in the first half of the year. During the reporting period, Wanda Film’s operating income was 4.478 billion yuan, an increase of 60.97% over the same period last year; net profit attributable to shareholders of listed companies reached 692 million yuan, an increase of 1340.97% over the same period last year.

A win-win deal for everyone?

Wanda Film is "holding hands" with Shanghai Confucianism and Italy again, which may be a win-win deal for each person.

According to public information, Shanghai Ruyi Film and Television Production Company has participated in the production of 44 cinema films since its establishment. In 2023, the main products of "Exchange Life", "Keep You Safe" and "Warm" have landed in this year’s Spring Festival file, Qingming file and summer file respectively, and obtained 393 million yuan, 700 million yuan and 913 million yuan box office.

In previous years, Shanghai Ruyi has also participated in the production of "Hello, Li Huanying", "Walking Alone on the Moon", "Send You a Little Red Flower" and other popular cinema films. Its TV drama representative works include "No War in Peiping", "Langya Bang", "The Legend of Mi Yue", "Old Tavern" and so on.

In the upstream content production side of the film and television industry, Shanghai Ruyi has certain quality control capabilities. This time, Shanghai Ruyi’s stake in Wanda Film intends to open up the upstream and downstream resources of the industry, which is conducive to fully tapping the value of content.

In addition, Shanghai Ruyi has also launched a streaming platform, Pumpkin Movies. Its parent company, China Ruyi, has also cooperated with Tencent in game distribution. In the future, the linkage of film games may be the main development direction of China Ruyi.

According to the third quarter earnings report of 2023, as of September 30, Wanda Film has 877 cinemas and 7,338 screens. Among them, there are 709 directly-operated cinemas and 6,159 screens. The company’s box office share in the Chinese mainland film market in the first three quarters is as high as 16.5%, ranking first in the industry.

For Wanda, the sale of Wanda investment shares will ease the financial pressure to some extent. At the same time, in the film and television content production side, it has welcomed important allies.

In recent years, Wanda Film’s main control of popular works has become the norm. In addition to the Chinatown series IP, Wanda Film rarely has a major movie box office breaking 1 billion works. In 2022, the highest box office of the company’s main theater film is 547 million yuan "Brother, Hello".

As of December 12, there are only two cinema movies produced by Wanda Film in 2023. One is the May 1st "Countdown to Say I Love You", which has a cumulative box office of 26.37 million yuan.

The other is about to be released, by Chen Sicheng, Zhang Ji as the screenwriter, Zhang Yi and other starring "Three Brigade".

At present, the film is launching a national roadshow, and the total box office of the premiere and pre-sale has exceeded 78 million yuan. Judging from the word-of-mouth and box office performance of the current premiere, the film is expected to become a strong contender for the box office championship of the New Year’s Eve in 2023.

At present, the integration of the upstream and downstream of the film and television industry has many positive implications for promoting the healthy and diversified development of the industry. For both parties, this may also be a win-win transaction. And this kind of transaction is not the first time in the industry, and it will not be the last.